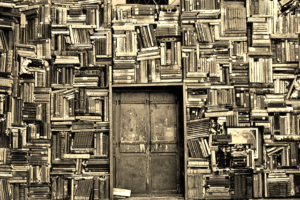

Do Your Loved Ones (and You) a Favor – Declutter Your Domicile.

Decluttering is becoming de rigueur as many of us are realizing we have far too much stuff taking over our attics, basements, garages, closets, not to mention living spaces. Once we get past the notion that everything we own is essential to our happiness, reducing our stuff actually feels pretty good. On top of that, if you’re up there in years, decluttering will help those charged with cleaning out your home avoid a Sisyphean task. This will also enable you to discard any items that could prove embarrassing to a family member. Unfortunately, my parents retained all our report cards and, in my situation, an abundance of school disciplinary reports. When cleaning out our mother’s apartment, my siblings chortled for days after finding a letter expelling me from Yale at the age of two, actually from a playschool for faculty brats.

Decluttering is a time-consuming chore that is not without some painful decisions, so be sensitive to a spouse or partner who is involved in the process. A few well-regarded rules of thumb are, first, if you haven’t used the item in the past year, you probably don’t need it. Whatever it is you’re deciding on, if it has no sentimental value or otherwise touches your soul, don’t hold onto it. Saying: “I’ve been looking for that for years” really means you had long forgotten that you even had it, so you clearly can get through life without it. Finally, regularly repeat this mantra: “When in doubt, throw it out” or, better yet, donate it.

Smart Money Tips

- Are your valuable possessions adequately insured? The coverage provided by your homeowner’s or renter’s policy for valuables is pitifully low. For example, you’re probably limited to $1,000 to $2,000 of coverage for all jewelry and other valuables. If you have jewelry, art, antiques, or collectibles, you need a rider on your homeowner’s or renter’s insurance policy. A so-called “floater policy” will provide coverage if any valuables are stolen, lost, or damaged based on what it would cost to replace them. The amount of coverage for each item is based upon sales receipts and appraisals you have provided to your insurance company when you obtain the extra coverage. This may be inconvenient, but far less painful than losing valuables only to find that you have scant coverage for them.

- Heads up for IRS and Social Security phone scams. The scam artists are out in force using sophisticated tools to separate you from your money. The miscreants purport to be from IRS or Social Security Administration and typically solicit personal information. If you don’t provide it, you’ll be told that all manner of calamity will befall you like arrest, license revocation, or deportation. Here’s what to keep in mind. If you owe taxes, the IRS will always inform you by mail. While in rare instances Social Security may call you, they won’t demand your personal information. The IRS or Social Security will not ask for credit card numbers over the phone, nor request a prepaid debit card, or wire transfer. Whether the call you receive is from a real person or, more likely, a robot, just hang up. Anyone is susceptible to these and other scams, but none more than seniors. If you are a senior, always check with a relative or friend before giving out any money or personal information, particularly if they demand immediate action.

Food for Thought

If all our misfortunes were laid in one common heap, whence everyone must take an equal portion, most people would be content to take their own and depart.

-Socrates

Money Can Be Funny

Anyone who lives within their means suffers from a lack of imagination.

-Oscar Wilde

Word of the Week

usufruct (YOO-zuh-fruhkt) – The right to use and enjoy another’s property without destroying it.

Origin: From Latin ususfructus, from usus et fructus (use and enjoyment)

Her relatives assumed they had perpetual usufruct privileges to her Cape Cod vacation home.